Accounting For Bonds Payable

He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

Calculating the Present Value of a 9% Bond in an 8% Market

The yield to maturity formula takes into account interest payments and capital gains. At the end of the 5 years the entire discount will have been charged to the profit and loss account and the discount on the bonds payable account will be zero. At the end of the 5 years the entire premium will have been taken to the profit and loss account and the premium on the bonds payable account will be zero. An investor should be prepared to pay the present value of the cash flows from the bond (the bond price).

Bond Issue at Par Value

By doing so, investors earn a greater return on their reduced investment. The net result is a total recognized amount of interest discount on bonds payable on balance sheet expense over the life of the bond that is greater than the amount of interest actually paid to investors. The amount recognized equates to the market rate of interest on the date when the bonds were sold.

Bonds Issued At Par

The difference between an interest rate of 6.5% and 6.75% is 25 basis points. Using debt (such as loans and bonds) to acquire more assets than would be possible by using only owners’ funds. The systematic allocation of an intangible asset to expense over a certain period of time. Bonds that have specific assets pledged as collateral are secured bonds.

Cash Flow Statement

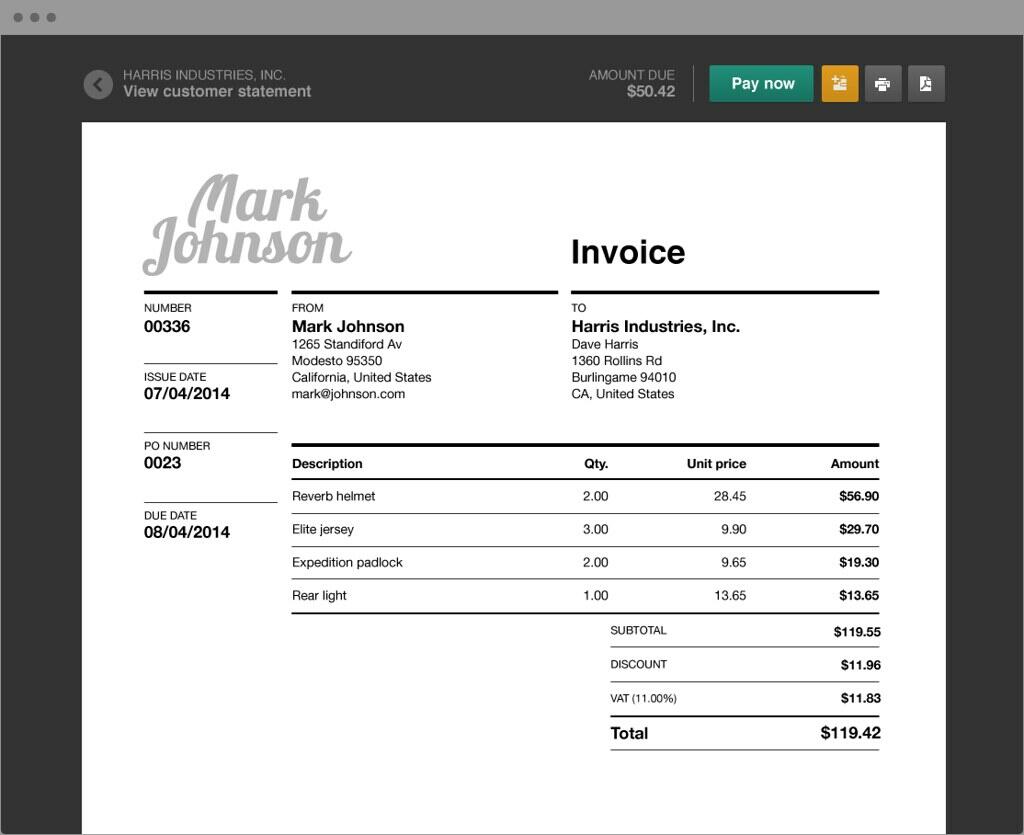

Regularly, a bond’s value is not equal to its current market price at the date of issuance. For that reason, a bond will be issued at a premium or discount. Bonds will have a stated rate of interest dictating the value of the periodic interest payments. However, market interest rates change frequently, so the interest rate stated on the bond may be different from the current interest rate at the time of bond issuance.

For example, if a bond has a stated rate of 9% while the market offers 10%, it sells at a discount. The cash received is calculated as the face value multiplied by the discount percentage. Over the bond’s life, the discount is amortized into interest expense, increasing the carrying value of the bond until maturity, when the full face value is repaid. This process involves journal entries for cash, interest expense, and the discount on bonds payable.

Due to the market rate and coupon rate, company may issue the bonds with discount to the investor. Company will discount to attract investors when the coupon rate is lower than the market rate. Thus, Schultz will repay $47,722 ($140,000 – $92,278) more than was borrowed. Spreading the $47,722 over 10 six-month periods produces periodic interest expense of $4,772.20 (not to be confused with the periodic cash payment of $4,000).

- Reducing the bond premium in a logical and systematic manner is referred to as amortization.

- On January 1, 2024 the book value of this bond is $104,100 ($100,000 credit balance in Bonds Payable + $4,100 credit balance in Premium on Bonds Payable).

- We have our interest payable that we’re going to pay off tomorrow and then we have the discount that we have to amortize over the 10 periods.

- During each of the subsequent years 2025, 2026, 2027, and 2028 the corporation will have twelve months of interest expense equal to $9,000 ($100,000 x 9% x 12/12).

- And a lot of the principles between straight line and effective are very similar.

The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. This account is a non-operating or “other” expense for the cost of borrowed money or other credit. Callable bonds are bonds that give the issuing corporation the right to repurchase its bonds by paying the bondholders the bonds’ face amount plus an additional amount known as the call premium.

Finally, at the end of the 5 year term (the maturity date) the bonds payable have to be paid and the following journal completes the transaction. The investors are prepared to pay the face value 100,000 as the bond rate is the same as the market rate. Historically, bonds where issued in paper form with a coupon attached to them representing each interest payment. On the due date the bond holder would remove the coupon and exchange it at the bank for the interest payment. As the interest rate was identified on this coupon it became known as the bond coupon rate.

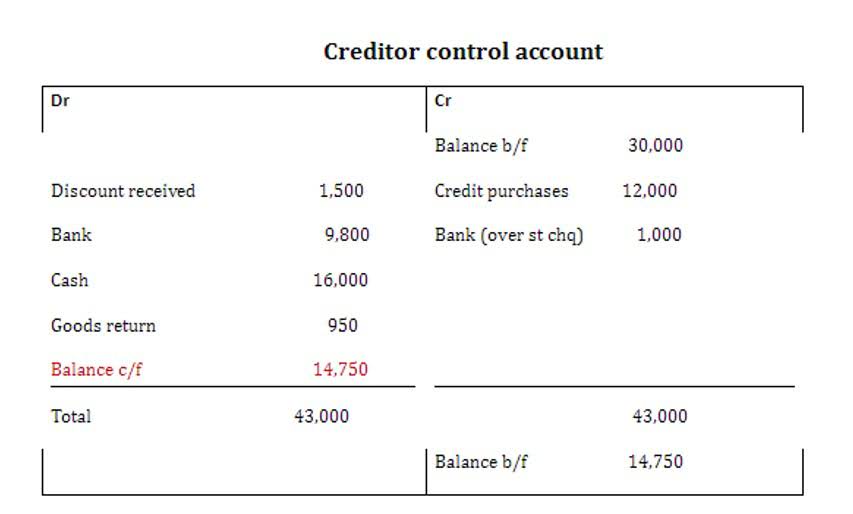

Company A recorded the bond sale in its accounting records by increasing Cash in Bank (debit asset), Bonds Payable (credit liability) and the Discount on Bonds Payable (debit contra-liability). The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the par value of the bonds in the liabilities section of the balance sheet. Generally, if the bonds are not maturing within one year of the balance sheet date, the amounts will be reported in the long-term or noncurrent liabilities section of the balance sheet. The premium or discount on bonds payable is the difference between the amount received by the corporation issuing the bonds and the par value or face amount of the bonds. If the amount received is greater than the par value, the difference is known as the premium on bonds payable. If the amount received is less than the par value, the difference is known as the discount on bonds payable.

This method of accounting for bonds is known as the straight-line amortization method, as interest expense is recognized uniformly over the life of the bond. Notice that interest expense is the same each year, even though the net book value of the bond (bond plus remaining premium) is declining each year due to amortization. Another way to illustrate this problem is to note that total borrowing cost is reduced by the $8,530 premium, since less is to be repaid at maturity than was borrowed up front. The entire transaction of bonds payable on balance sheet is recorded affecting different accounts in balance sheet of the company.

As a result, interest expense each year is not exactly equal to the effective rate of interest (6%) that was implicit in the pricing of the bonds. For 20X1, interest expense can be seen to be roughly 5.8% of the bond liability ($6,294 expense divided by beginning of year liability of $108,530). For 20X4, interest expense is roughly 6.1% ($6,294 expense divided by beginning of year liability of $103,412). The present value is given by the present value of the principal repayment plus the present value of the regular annuity created by the interest payments.

Since these bonds will be paying the investors less than the market rate of interest ($300,000 semiannually instead of $305,000), the investors will pay less than $10,000,000 for the bonds. Discount on bonds payable (or bond discount) occurs when a corporation issues bonds and receives less than the bonds’ face or maturity amount. The root cause of the bond discount is the bonds have a stated interest rate which is lower than the market interest rate for similar bonds. The issuer needs to recognize the financial liability when publishing bonds into the capital market and cash is received. The company has the obligation to pay interest and principal at the specific date.

Bond Price

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. The above entry is made to showcase the settlement of Bonds Payable after the principal amount has subsequently been made. Before the settlement, Bonds Payable are represented as a Long Term Liability (Non-Current Liability) on the Balance Sheet. Therefore, Bonds Payables are presented under Non-Current Liabilities (if they are supposed to be settled after a period of one year) in the company’s Balance Sheet. In other words, one percentage point is equal to 100 basis points.

- In other words, if the bonds are a long-term liability, both Bonds Payable and Premium on Bonds Payable will be reported on the balance sheet as long-term liabilities.

- The accounting process carried out when working with bonds payable is illustrated in the following example.

- When a bond is issued at par, the carrying value is equal to the face value of the bond.

- At every coupon payment, interest expense will be incurred on the bond.

- The bond will mature in 5 years and requires interest payments on June 30 and December 31 of each year until December 31, 2028.

The restricted account is Bond Sinking Fund and it is reported in the long-term investment section of the balance sheet. Use the semiannual market interest rate (i) and the number of semiannual periods (n) that were used to calculate the present value of the interest payments. To obtain the proper factor for discounting a bond’s maturity value, use the PV of 1 table and use the same “n” and “i” that you used for discounting the semiannual interest payments. Let’s examine the effect of a decrease in the market interest rates. First, let’s assume that a corporation issued a 9% $100,000 bond when the market interest rate was also 9% and therefore the bond sold for its face value of $100,000. Throughout our explanation of bonds payable we will use the term stated interest rate or stated rate.